Use this function to enter those accounts whose balances are to be allocated to other accounts, along with the details on how to make such allocations. You specify both the accounts to receive the allocation as well as the method of allocation. There are three methods available for distributing allocations. The "Percent" method allows distributions of a fixed percentage of the current balance to a given account. The "Amount" method allows a distribution for a fixed dollar amount. The "Ratio" method allows a distribution of the current balance based on a ratio of accounts from the Chart of Accounts or Unit Accounts files. An Over/Under account must be specified to receive the remainder from the allocations.

Journal entries that effect the allocations are created when the Create Allocation Entries job is run in Live Operations (from Journal Entries on the Daily Pulldown Menu). These journal entries back out amounts stored in the allocation accounts and distribute them to the receiving accounts as defined in this function.

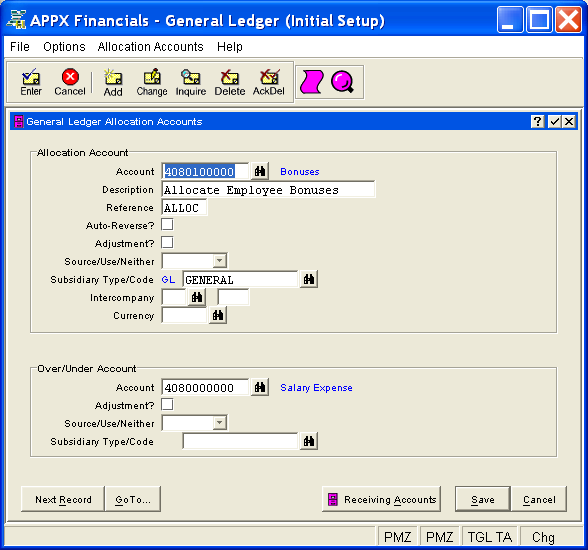

The Allocation Accounts Screen, shown in Figure 4-9 below, appears when

you select Allocation Accounts

from the File Maintenance

Pulldown Menu. You normally enter this function in Inquire mode but

you can change mode by using the mode icons on the toolbar or the mode

function keys. Since Change mode places a hold on the selected record,

use Change mode only when you intend to change data. If desired, in key

entry, you can click on ![]() or press the Scan key to review

the records currently on file and select one for editing or viewing.

or press the Scan key to review

the records currently on file and select one for editing or viewing.

Figure 4-9. Allocation Accounts Screen

This screen contains the following fields grouped by sections.

Enter the account which contains the dollar amount to be allocated.

This account must be on file in the Chart

of Accounts file. You can click on ![]() or press the Scan

key to find an appropriate entry. The system displays the account description

so that you can verify your entry.

or press the Scan

key to find an appropriate entry. The system displays the account description

so that you can verify your entry.

If desired, enter a description for this allocation, up to 30 characters in length. This field will flow through to the journal entries created during Create Allocation Entries and will be printed on the journal and the distribution reports as a part of your audit trail.

If desired, enter a reference for these transactions, up to 6 characters in length. This field will flow through to the journal entries created during Create Allocation Entries and will be printed on the journal and the distribution reports as a part of your audit trail.

Select "yes" or ![]() if reversing journal entries

should be created automatically during Close Month processing for the

months journal entries have been created for this allocation; otherwise,

select "no" or

if reversing journal entries

should be created automatically during Close Month processing for the

months journal entries have been created for this allocation; otherwise,

select "no" or ![]() . The initial default is "no".

. The initial default is "no".

Select "yes" or ![]() if allocation entries to

the Allocation Account are an

adjustment to the sources/uses amounts; otherwise, select "no"

or

if allocation entries to

the Allocation Account are an

adjustment to the sources/uses amounts; otherwise, select "no"

or ![]() . The initial default is "no".

. The initial default is "no".

If "yes", a credit adjustment reduces month-to-date and year-to-date uses and a debit adjustment reduces month-to-date and year-to-date sources in the Account Balances file.

If applicable, specify how the allocations are to be accumulated for

the Allocation Account in the

Account Balances file; otherwise, leave this field blank for standard

treatment. Click the list  button to select one of the options

listed below:

button to select one of the options

listed below:

|

<blank> |

Credits are accumulated as sources; debits are accumulated as uses. |

|

Source: |

This allocation is to be accumulated as a source. |

|

Use: |

This allocation is to be accumulated as a use. |

|

Neither: |

This allocation is to be accumulated as neither. |

The system displays the subsidiary type defined for the Allocation Account in Chart of Accounts File Maintenance on the Details Overlay.

If Subsidiary Type for the

allocation account is "GL", you must enter a subsidiary code

so that postings can be made to the appropriate subsidiary files; otherwise,

you can leave this field blank. Subsidiary

Code is only used in General Ledger for subsidiary type "GL".

If entered and if General Subsidiary is part of your system, this code

must be on file in the Subsidiary Codes file. You can click on ![]() or press the Scan key to find an appropriate entry.

or press the Scan key to find an appropriate entry.

If this is an intercompany transaction, enter the code identifying the

company; otherwise, leave this field blank. If entered, this code must

be on file in the Intercompany

Names file. You can click on ![]() or press the Scan key

to find an appropriate entry. The system displays the intercompany name

so that you can verify your entry. All intercompany allocation postings

will be posted to the YTD Postings file.

or press the Scan key

to find an appropriate entry. The system displays the intercompany name

so that you can verify your entry. All intercompany allocation postings

will be posted to the YTD Postings file.

If desired for an intercompany transaction, enter a reference up to 4 characters in length; otherwise, leave this field blank. This field will flow through to the journal entries created during Create Allocation Entries and will be printed on the journal and the distribution reports as part of your audit trail.

If this transaction is in a currency other than the domestic currency,

enter the currency code; otherwise, leave this field blank. If entered,

this code must be on file in the Exchange

Rates file. You can click on ![]() or press the Scan key

to find an appropriate entry. The system displays the currency description

so that you can verify your entry.

or press the Scan key

to find an appropriate entry. The system displays the currency description

so that you can verify your entry.

Enter the account to be used for any over/under amounts that may result

when the allocations are calculated. This account must be on file in the

Chart of Accounts

file. You can click on ![]() or press the Scan key to find an

appropriate entry. The system displays the account description so that

you can verify your entry.

or press the Scan key to find an

appropriate entry. The system displays the account description so that

you can verify your entry.

Note: Unpredictable results may occur if the Over/Under Account is the same account as the Allocation Account.

Select "yes" or ![]() if entries to the Over/Under

Account are an adjustment to the sources/uses amounts; otherwise,

select "no" or

if entries to the Over/Under

Account are an adjustment to the sources/uses amounts; otherwise,

select "no" or ![]() . The initial default is "no".

. The initial default is "no".

If "yes", a credit adjustment reduces month-to-date and year-to-date uses and a debit adjustment reduces month-to-date and year-to-date sources in the Account Balances file.

If applicable, specify how amounts are to be accumulated for the Over/Under Account in the Account Balances

file; otherwise, leave this field blank for standard treatment. Click

the list  button to select one of the options listed below:

button to select one of the options listed below:

|

<blank> |

Credits are accumulated as sources; debits are accumulated as uses. |

|

Source: |

The over/under amount is to be accumulated as a source. |

|

Use: |

The over/under amount is to be accumulated as a use. |

|

Neither: |

The over/under amount is to be accumulated as neither. |

The system displays the subsidiary type defined for the Over/Under Account in Chart of Accounts File Maintenance on the Details Overlay.

If Subsidiary Type for the

Over/Under Account is "GL",

you must enter a subsidiary code so that postings can be made to the appropriate

subsidiary files; otherwise, you can leave this field blank. Subsidiary

Code is only used in General Ledger for subsidiary type "GL".

If entered and if General Subsidiary is part of your system, this code

must be on file in the Subsidiary Codes file. You can click on ![]() or press the Scan key to find an appropriate entry.

or press the Scan key to find an appropriate entry.

Press ENTER or click  or the Save button to save the information

for the current record. If any information has changed, the system may

redisplay the screen to show any new or changed system-supplied items

or to report any error or warning messages. If so, the current record

has not yet been saved; you must address any concerns and press ENTER

or click

or the Save button to save the information

for the current record. If any information has changed, the system may

redisplay the screen to show any new or changed system-supplied items

or to report any error or warning messages. If so, the current record

has not yet been saved; you must address any concerns and press ENTER

or click  or the Save

button again. To exit without saving, press END or click

or the Save

button again. To exit without saving, press END or click  or the Cancel

button.

or the Cancel

button.

When you save a record, the system will automatically present the Allocation Receiving Accounts Overlay, or you can click on the Receiving Accounts button to access it (which first saves the current record if applicable).

The following icons are also available for use on the toolbar (unless disabled in Add mode or until a record has been retrieved):

List Allocation Accounts:

See Allocation Accounts List

for further information.

List Allocation Accounts:

See Allocation Accounts List

for further information.

Display Allocation Audit

Info: See Audit

Info for further information.

Display Allocation Audit

Info: See Audit

Info for further information.

Click the appropriate icon to perform the desired operation (which first saves the current record if applicable), after which you will return to where you are.